saitomontazh.ru

Tools

Paycheck Withholding Rates

The employee tax rate for Medicare is % — and the employer tax rate is also %. So, the total Medicare tax rate percentage is %. Only the employee. An employer who withholds a portion of an employee's wages for payment of federal income tax must withhold state income tax. This includes employers of some. Generally, you want about 90% of your estimated income taxes withheld and sent to the government This ensures that you never fall behind on income taxes . Income Tax Withholding Tables Per Diem Payroll Period Daily Weekly Payroll Period Once per week Bi-Weekly Payroll Period Every two weeks. You can use the Tax Withholding Estimator to estimate your income tax for next year. The Tax Withholding Estimator compares that estimate to your current tax. The total income tax required to be withheld on wages for the purposes of the withholding tables and schedules is calculated without regard to the marginal. Employers pay part of these payroll taxes. A CLOSER LOOK AT PAYROLL TAXES. As an example, let's say the payroll tax rates are as follows. DAILY OR MISCELLANEOUS PAYROLL PERIOD (Allowance $). If the amount of taxable. The amount of income wages is: tax to be withheld is: Over. But Not Over. Federal payroll tax rates · Social Security tax: Withhold % of each employee's taxable wages until they earn gross pay of $, in a given calendar. The employee tax rate for Medicare is % — and the employer tax rate is also %. So, the total Medicare tax rate percentage is %. Only the employee. An employer who withholds a portion of an employee's wages for payment of federal income tax must withhold state income tax. This includes employers of some. Generally, you want about 90% of your estimated income taxes withheld and sent to the government This ensures that you never fall behind on income taxes . Income Tax Withholding Tables Per Diem Payroll Period Daily Weekly Payroll Period Once per week Bi-Weekly Payroll Period Every two weeks. You can use the Tax Withholding Estimator to estimate your income tax for next year. The Tax Withholding Estimator compares that estimate to your current tax. The total income tax required to be withheld on wages for the purposes of the withholding tables and schedules is calculated without regard to the marginal. Employers pay part of these payroll taxes. A CLOSER LOOK AT PAYROLL TAXES. As an example, let's say the payroll tax rates are as follows. DAILY OR MISCELLANEOUS PAYROLL PERIOD (Allowance $). If the amount of taxable. The amount of income wages is: tax to be withheld is: Over. But Not Over. Federal payroll tax rates · Social Security tax: Withhold % of each employee's taxable wages until they earn gross pay of $, in a given calendar.

with regular wages but do not specify the amount of each, withhold income tax as if the total were a single payment for a regular payroll period. If you pay. A payroll tax includes the taxes employees and employers pay on wages, tips, and salaries. For employees, taxes are withheld from their paychecks and paid to. For information on Hawaii rates, please refer to the Appendix of Booklet A, Employer's Tax Guide for tax withholding rates and tables. How do I e-pay. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Payroll deduction amounts depend on the province or territory of employment. While federal income tax is the same across Canada, provincial and territorial tax. The Social Security tax rate is %, half of which is paid by the employee and the other half by the employer. This tax has an annual wage base limit of $ Tax (PIT) are withheld from employees' wages. Employer Contributions. Most employers are tax-rated employers and pay UI taxes based on their UI rate. For and , the OASDI tax rate is reduced by 2 percentage points for employees and for self-employed workers, resulting in a percent effective tax. Employer · Who must withhold? · Common questions · Employer Withholding Tax Guide and Tables (W) · Publication - Guide to WI Wage Statements and Information. Withhold taxes from each employee's paycheck; File a quarterly withholding Withholding Tax Tables.. . . . How to file and pay. Taxpayers who. FUTA (Employer-Paid) · Maximum Taxable Earnings. $7, · Percent of Taxable Wages. % · Maximum Credit. % · Normal Net Tax. %. FUTA is a payroll tax only paid by employers, not employees. The current FUTA rate is 6% with a wage limit of $7, for each employee per year. There's a. Federal tax withholding calculations ; Single Withholding Rates · $0 - $6, · $6, - $11, · plus 10% of income over $6, ; Married Withholding Rates. The employee should complete a withholding certificate accordingly. Tax withholding on large one-time payments such as awards is at a flat 2 percent rate if. Calculating Income Tax Withholding · Guideline – Income Tax Withholding & Information Returns · Income Tax Withholding Rates and Instructions. Review and calculate the federal income tax brackets and rates in the U.S and understand how they apply to you from H&R Block's tax experts. Overview of withholding and payroll formulas, rates and deductions. How to Calculate Withholding ; Divide line 6 by line 7. This is your Arizona withholding goal per paycheck, $1, / 22 = $ ; Percentage: Divide line 8 by. California Withholding Schedules · Low Income Exemption · Estimated Deduction · Standard Deduction · Personal Exemption Credit · Annual Payroll Period · Daily/. If you prefer, you may use the automated payroll method to figure the amount of Illinois. Income Tax you should withhold. Tax withheld x. (Wages — (.

Forex Trading Hong Kong

In Hong Kong, you can carry out leveraged forex trading through a corporation licensed with the SFC for carrying out such regulated activity. A hour trading day begins in the Asia-Pacific region, starting with Sydney, followed by Tokyo, Hong Kong, and Singapore. It then continues through Europe. Trade forex on an award-winning platform. Access FX pairs across majors, minors and exotics, plus spot metals, from only pips. DBS SME foreign exchange account provides online foreign currency trading, spot forex, forex forward, forex option and forex time option forward in a more. View Hang Seng Index index pricing chart, leverage info, latest research and price drivers. Trade the Hong Kong 50 index at saitomontazh.ru saitomontazh.ru Forex HK Limited is a wholly owned subsidiary of GMO Financial Holdings,Inc ( JP), and is an affiliated company of GMO CLICK Securities, Inc. The USD/HKD exchange rate has been loosely pegged since , which maintains an exchange rate between and This peg is set by the Hong Kong Monetary. Citi Plus. No minimum deposit requirement · Promotional Offers: · Genuine 0% spread1 with no profit margins for the Bank! · Apart from the trading offers, you. EBSI Forex provides a state-of-the-art online trading platform, up-to-date trading information, and diverse investing instruments and resources. In Hong Kong, you can carry out leveraged forex trading through a corporation licensed with the SFC for carrying out such regulated activity. A hour trading day begins in the Asia-Pacific region, starting with Sydney, followed by Tokyo, Hong Kong, and Singapore. It then continues through Europe. Trade forex on an award-winning platform. Access FX pairs across majors, minors and exotics, plus spot metals, from only pips. DBS SME foreign exchange account provides online foreign currency trading, spot forex, forex forward, forex option and forex time option forward in a more. View Hang Seng Index index pricing chart, leverage info, latest research and price drivers. Trade the Hong Kong 50 index at saitomontazh.ru saitomontazh.ru Forex HK Limited is a wholly owned subsidiary of GMO Financial Holdings,Inc ( JP), and is an affiliated company of GMO CLICK Securities, Inc. The USD/HKD exchange rate has been loosely pegged since , which maintains an exchange rate between and This peg is set by the Hong Kong Monetary. Citi Plus. No minimum deposit requirement · Promotional Offers: · Genuine 0% spread1 with no profit margins for the Bank! · Apart from the trading offers, you. EBSI Forex provides a state-of-the-art online trading platform, up-to-date trading information, and diverse investing instruments and resources.

CFD and Forex Trading Hours - Market Sessions ; GB, Monday — Friday ( — ), — ; HK50, Monday — Friday ( — , — , — ), —. Opening an individual forex account online with Rakuten Securities Hong Kong is straightforward and convenient. First, fill out our secure account. Suggestions for Forex trading platform for Hong Kong resident (we have no capital gains tax) Archived post. New comments cannot be posted and. The short answer is yes, forex trading is legal in Hong Kong. The Securities and Futures Commission (SFC) is the regulatory body responsible for. Emperor International Exchange is a leading provider of Forex trading platforms and services in Hong Kong. Learn more and start trading today! A licenced foreign exchange trading firm in Hong Kong. Rakuten Securities, Inc. has 10+ years of FX trading experience with an online 24/7 platform. It's a market where the most skilled traders test their knowledge of the industry and utilise their appetite for success to get results – and they use FXOpen as. Highlights · Grow your wealth with our Foreign Currency Time Deposit · Make your money work harder, and enjoy the ease of conducting FX trading and placing a. In addition,. Hong Kong remained the world's most active offshore renminbi FX and interest rate derivatives market. The average daily turnover of FX. Retail Forex traders make up the smallest market players. Compared to higher-level traders, they typically have limited purchasing power and require a forex. With HSBC's ForEx service you can buy or sell foreign currencies online. Find out the latest exchange rates and facilitate your monetary transactions. RISK OF TRADING IN LEVERAGED FOREIGN EXCHANGE CONTRACTS Service relating to leveraged foreign exchange trading is provided by saitomontazh.ru Forex HK Limited. Our company offers trading of currencies of G7 economies, allowing clients to trade different currencies 24 hours a day and grasp every opportunity in the. DBS SME foreign exchange account provides online foreign currency trading, spot forex, forex forward, forex option and forex time option forward in a more. Saxo Capital Markets HK Limited (“Saxo”) is a company authorised and regulated by the Securities and Futures Commission of Hong Kong. Saxo holds a Type 1. 6 Best Forex Brokers in Hong Kong (*) · ☑️ Saxo Bank – A fully licensed and regulated Danish bank. · ☑️ FP Markets – Top in MetaTrader and Zero Spread trading. For funded accounts after a challenge, the payout is between 80% and 90%. This means that the Forex proprietary firm only keeps 10% to 20% of the profits that. Hong Kong is considered as one of the major financial markets in the Asian continent that has a great significance in the Forex trading market. With our top-tier Hong Kong-based VPS for forex, you'll gain access to lightning-fast trade execution, ultra-low latency, and a robust trading environment. Our online FX trading platform lets you execute and track transactions from anywhere HKD. Hong Kong Dollar. HUF. Hungarian Forint. ILS. Israel Shekel. INR.

How Much Does It Cost For Norton Antivirus

$first yr. Get Advantage. See subscription details below.*. Protection for 10 PCs, Macs, tablets, or smartphones. Norton for mobile provides powerful layers of phone protection and award-winning mobile security for your Apple device. It combines security and antivirus. $ first yr. 1 year of protection for 1 mobile device. Savings compared to the renewal price of $/year. See subscription. for 5 Devices; $/mo. for 10 Devices). Other terms may apply. Limited-time offer. 2 Norton Parental Control can only be installed and used on a. Compare Plans ; Norton AntiVirus. Plus · C$ ; Norton Standard · C$ ; Norton Deluxe · C$ ; Norton Premium · C$ See detailed pricing plans for Norton AntiVirus. Compare costs with competitors and find out if they offer a free version, free trial or demo. Looking for Android™ smartphone or tablet protection? $ first yr. 1 year of protection for 1 mobile device. Savings compared to the renewal price of. How do you want your item? I want shipping & delivery savings with Walmart plus. You get 30 days free! Choose a plan at checkout. Called Norton to ask why and they said they charge more for auto renewal because most people just pay it. A crazy pricing model Helpful. Share. $first yr. Get Advantage. See subscription details below.*. Protection for 10 PCs, Macs, tablets, or smartphones. Norton for mobile provides powerful layers of phone protection and award-winning mobile security for your Apple device. It combines security and antivirus. $ first yr. 1 year of protection for 1 mobile device. Savings compared to the renewal price of $/year. See subscription. for 5 Devices; $/mo. for 10 Devices). Other terms may apply. Limited-time offer. 2 Norton Parental Control can only be installed and used on a. Compare Plans ; Norton AntiVirus. Plus · C$ ; Norton Standard · C$ ; Norton Deluxe · C$ ; Norton Premium · C$ See detailed pricing plans for Norton AntiVirus. Compare costs with competitors and find out if they offer a free version, free trial or demo. Looking for Android™ smartphone or tablet protection? $ first yr. 1 year of protection for 1 mobile device. Savings compared to the renewal price of. How do you want your item? I want shipping & delivery savings with Walmart plus. You get 30 days free! Choose a plan at checkout. Called Norton to ask why and they said they charge more for auto renewal because most people just pay it. A crazy pricing model Helpful. Share.

Antivirus software is available on its own or bundled with credit monitoring, parental controls, VPNs, etc. · Prices start at $ per month, billed yearly. Norton - Deluxe (3 Device) Antivirus Internet Security Software + VPN + Dark Web Monitoring (1 Year Subscription) - Android, Mac OS, Windows, Apple iOS. Green tag items show member pricing is available. Already have a Micro Center Internet Connection. Package Contents. What's in the Box. Norton AntiVirus Plus. You can protect that device with Norton as well. System requirements. Number Prices are INC VAT. We never charge additional shipping or service fees. Learn more about Norton AntiVirus pricing plans including starting price, free versions and trials. On its own, Norton Antivirus Plus costs $ for the first year. However, students registered with Student Beans can get it for $ a month. Is there a free. Norton Antivirus Pricing Overview ; Small Business. $per year. The protection and simplicity of Norton, built for your business. Norton offers antivirus and security software to nonprofits for devices that are not part of managed networks. Admin Fee: $ This plan costs first-year users $ and then rises to $ Finally is the top-tier package for users who are serious about cyber security. Norton Im happy with the program, I've had a positive experience and it's running great so far. View more. Image 1 of customer photos. Review from Bazaarvoice. Compare similar products ; User rating, out of 5 stars with reviews. (). $Your price for this item is $ ; User rating, out of 5 stars. Norton AntiTrack. $$ Available now · Norton AntiVirus Plus. $$ $$ Available now · Norton Secure VPN. $$ Available now. It doesn't have a free antivirus product, Norton has four levels of paid malware protection. Parental controls feature is reserved for its pricest tier. None of. See detailed pricing plans for Norton AntiVirus. Compare costs with competitors and find out if they offer a free version, free trial or demo. AARP commercial member benefits are provided by third parties, not by AARP or its affiliates. Providers pay a royalty fee to AARP for the use of its. Then USD /year. Savings compared to 2 x annual renewal price of USD /year. See subscription details below.*. Subscribe now. USD Basic Plan: The basic plan is the most affordable option, starting at $ per year. It provides essential antivirus protection for one device. Standard Plan. How does Norton AntiVirus protect my computer? Whether you use your computer Prices shown are in U.S. Dollars. Please log in for your pricing. Buy Norton Antivirus Software at Staples and get Free next-day delivery when you spend $25 minimum. Norton Deluxe Antivirus/Internet Security for 3 Device - 12 Month · Norton Premium Antivirus Software - 10 Devices · Norton Deluxe 5 Devices 50gb PC.

Best Vision Insurance Colorado

The best vision insurance companies are Anthem and UnitedHealthcare, according to our analysis of rates and coverage options. Medical insurance is best for eye issues such as red eyes, dry eyes, allergy North Ave, Ste Grand Junction, Colorado ; () Delta Dental of Colorado and VSP Vision Care have partnered to bring you best-in-class vision benefits to complement our dental benefits. Save on employee vision benefits, and individual and family vision insurance plans With thousands of in-network independent eye doctors, top optical retailers. The amount of savings generated by your vision plan will depend on how many new products and services you purchase in a year. · The largest vision insurance. Purchase a VSP vision insurance plan today with no waiting period! Start using your vision plan immediately. Compare plans or build your plan now! Best Value Plan – largest selection of providers and lowest cost. Vision Plans. VSP Plan, EyeMed Access Plan. Apply · Apply. Network. VSP. Please see the "Who is eligible" section for more information. If you are enrolled in a managed care plan, you may have additional benefits not listed below. With VSP, your vision care comes first. We're committed to providing you with the best choices in eye doctors and eyeglasses, all while saving you hundreds! The best vision insurance companies are Anthem and UnitedHealthcare, according to our analysis of rates and coverage options. Medical insurance is best for eye issues such as red eyes, dry eyes, allergy North Ave, Ste Grand Junction, Colorado ; () Delta Dental of Colorado and VSP Vision Care have partnered to bring you best-in-class vision benefits to complement our dental benefits. Save on employee vision benefits, and individual and family vision insurance plans With thousands of in-network independent eye doctors, top optical retailers. The amount of savings generated by your vision plan will depend on how many new products and services you purchase in a year. · The largest vision insurance. Purchase a VSP vision insurance plan today with no waiting period! Start using your vision plan immediately. Compare plans or build your plan now! Best Value Plan – largest selection of providers and lowest cost. Vision Plans. VSP Plan, EyeMed Access Plan. Apply · Apply. Network. VSP. Please see the "Who is eligible" section for more information. If you are enrolled in a managed care plan, you may have additional benefits not listed below. With VSP, your vision care comes first. We're committed to providing you with the best choices in eye doctors and eyeglasses, all while saving you hundreds!

From health and dental insurance to Medicare and Medicaid, it's important to understand how policies work and which companies are the best. Browse. Many employers offer vision benefits. These plans are a good way to help keep employees healthier and happier with affordable group coverage rates and easy. We've partnered with VSP® Vision Care, the nation's largest vision benefits administrator, to offer vision plans focused on overall health. With more than. Related Sites · VSP Individual Plans · VSP Vision · Eyeconic · Provider Hub · Eyes of Hope · Global Access Plan. Learn more about the Humana vision insurance options available to you in Colorado. Find the right vision coverage and plan options to fit your needs. Davis Vision has been providing comprehensive vision care benefits for over 50 years. Access to better vision begins with having the qualified eye care. VSP® Vision Care is the largest not-for-profit, full-service vision benefits provider in the United States with more than 50 years of experience. VSP provides. The OUTLOOK Vision network is comprised of national and regional providers such as Pearle Vision, Sears Optical, LensCrafters, JC Penny Optical, Eyemasters. insurance plan, and by also discussing options with your eyecare professional to see how best to apply your particular vision coverage to your eyecare expenses. Keep your vision clear with regular eye exams. Our vision plans offer an extensive network of optometrists and vision care specialists. To find an in-network. UnitedHealthcare vision insurance plans offer a variety of individual coverage options. Vision insurance helps cover eye exams, contacts, glasses and more. America's Best accepts most major vision insurance plans. · America's Best Vision Plan · Avesis · Aetna · Community Eye Care · DavisVision · EyeMed · Heritage Vision. VSP is the nation's leading vision benefits provider, offering 2 affordable personal plan options and the largest vision network in America. Both EyeMed and VSP have several good vision benefits plans to choose from that include discounts on eye exams, prescription eyewear, and corrective eye. Great news! With Aetna Vision Preferred Direct plans, you have no deductible. Eye exam copay. The amount you pay to the network provider for your routine eye. Top 10 Best VSP Insurance Eye Doctors in Colorado Springs, CO - August - Yelp - Eye Care Center of Colorado Springs, Pikes Peak Eye Care, Visionworks. HMO products underwritten by HMO Colorado, Inc. In Connecticut: Anthem Health Plans, Inc. In Georgia: Blue Cross Blue Shield Healthcare Plan of Georgia, Inc. In. Dental and vision insurance are great ways to help do that because they cover preventive dental care and eye exams – and more. Learn more about why coverage is. For decades, Superior Vision has been providing comprehensive vision care benefits Access to better vision begins with having qualified eye care professionals.

Roth Ira Advantages Over 401k

A Roth K helps you pay less in taxes if A) You have many years to retirement (think 10+ for example) B) You will have a higher income in retirement than you. Anyone with eligible earned income can open an IRA, but a (k) is only available through an employer. · A (k) has a higher contribution limit than an IRA. Both Roth IRAs and Roth (k)s are funded with after-tax dollars—meaning there's no upfront tax benefit for contributing. Income limits apply to Roth IRA contributions, however. For , if you are age 50 or older, you can make a contribution of up to $30, to your (k), (b). With Roth accounts, you pay taxes on contributions when you make them but won't when you withdraw them, as long as you meet certain requirements. Understanding. Both a Roth IRA and a (k) allow you to save on taxes—you'll save now with the traditional (k) and later with the Roth IRA. Your savings will grow tax-free, meaning you won't pay any tax on capital gains from your investments. In a Roth (k) account, you pay taxes on your contribution before it goes into your account. As a result, your take-home pay will be smaller when contributing. You can split your annual elective deferrals between designated Roth contributions and traditional pre-tax contributions, but your combined contributions can't. A Roth K helps you pay less in taxes if A) You have many years to retirement (think 10+ for example) B) You will have a higher income in retirement than you. Anyone with eligible earned income can open an IRA, but a (k) is only available through an employer. · A (k) has a higher contribution limit than an IRA. Both Roth IRAs and Roth (k)s are funded with after-tax dollars—meaning there's no upfront tax benefit for contributing. Income limits apply to Roth IRA contributions, however. For , if you are age 50 or older, you can make a contribution of up to $30, to your (k), (b). With Roth accounts, you pay taxes on contributions when you make them but won't when you withdraw them, as long as you meet certain requirements. Understanding. Both a Roth IRA and a (k) allow you to save on taxes—you'll save now with the traditional (k) and later with the Roth IRA. Your savings will grow tax-free, meaning you won't pay any tax on capital gains from your investments. In a Roth (k) account, you pay taxes on your contribution before it goes into your account. As a result, your take-home pay will be smaller when contributing. You can split your annual elective deferrals between designated Roth contributions and traditional pre-tax contributions, but your combined contributions can't.

The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to. One can do both if desired and affordable. k saves current tax, Roth saves future tax. IRA and (k) plan comparison ; Tax Benefits, Contributions are made with pre-tax funds but distributions are taxable, Contributions are made with after-tax. Because taxes are paid on the funds before they are transferred into the Roth, you'll owe no taxes on those funds if you take distributions in retirement—as. Pros. Wider range of investment options: Roth IRAs can offer a wider range of investment options than (k)s — you can choose a broker that offers the. With a Roth (k), your contributions are made after taxes and the tax benefit comes later: your earnings may be withdrawn tax-free in retirement. Traditional. When Roth contributions, along with any attributable earnings on them, are withdrawn from a plan in retirement, no taxes or penalties would be due as long as. If your employer offers a retirement plan, like a (k) or (b), and will match a percentage of your contributions, you should definitely take advantage. Traditional versions are better for saving on taxes today while Roth versions lower your taxes in retirement. Are you interested in saving for retirement but. Roth IRA · Contributions: Made with after-tax dollars; no immediate tax benefit. · Withdrawals: Qualified distributions are tax-free, including earnings, under. A big advantage of a Roth (k) is the absence of an income limit, meaning that even people with high incomes can still contribute. There's no tax deduction as there can be with a traditional IRA. But, any growth or earnings from the investments in the account—and any distributions you take. Think of it this way: With a Roth (k), you can get your tax obligation out of the way when your tax rate is low and then enjoy the tax-free earnings later in. Generally, you'll only be able to transfer a (k) to a Roth IRA if you are rolling over your (k), the plan allows in-service withdrawals, or the plan. Advantages · Large investment selection. · Qualified withdrawals in retirement are tax-free. · Contributions can be withdrawn at any time. · No required minimum. First, Roth IRA contributions are considered post-tax. You can withdraw those contributions at any time for any reason, tax, and penalty-free. The biggest difference between a (k) and IRA is flexibility. You can open an IRA at most financial institutions, and the range of investments to choose from. Benefits of a Traditional IRA: By investing pre-tax money in a Traditional IRA, you can reduce your current tax bill, allow your investments to grow tax-free. By contributing to a Roth IRA in addition to your traditional (k), you may be able to supplement your retirement savings and gain more flexibility in. Benefits of a Roth (k) · Retirement account with tax-free growth potential · Employee pays taxes now while in an assumed lower tax bracket than during.

Walmart Online Shopping With Ebt Card

Current federal approved retailers include: Amazon, BJs, Daily Table, Geissler's Supermarket, Shaw's, Star Market, Stop & Shop, and Walmart, as well as ALDI. Louisiana WIC (LA WIC) is partnering with WIC. Authorized Walmart stores in Louisiana to offer the use of LA WIC EBT cards at self-checkout lanes. Use your EBT card to shop securely for fresh produce and groceries at these participating stores in the New York City area: Amazon · ShopRite · Walmart. Visit. What is SNAP Online Purchasing? Can I use my benefits at any retailer? How will I know if these retailers can deliver to my home? Is using my EBT card online. If you don't have one create an account. • Select Payment Methods. • If your local store accepts EBT Online, you'll see an option to add your EBT card to. Yes, if you get CalFresh benefits, you can purchase groceries online at Albertsons, Safeway, Vons, Amazon, and Walmart using your EBT card. This is called "online purchasing" or "SNAP online." Several major retailers, including Amazon, Walmart, and Target, accept SNAP EBT cards for. 1) Order groceries at saitomontazh.ru or on the. Walmart Grocery mobile app. 2) During checkout, select EBT Card as payment method. 3) Swipe EBT card. You can pay for Walmart online grocery with EBT in all but five states. These states are Arkansas, Alaska, Louisiana, Maine, and Montana. Current federal approved retailers include: Amazon, BJs, Daily Table, Geissler's Supermarket, Shaw's, Star Market, Stop & Shop, and Walmart, as well as ALDI. Louisiana WIC (LA WIC) is partnering with WIC. Authorized Walmart stores in Louisiana to offer the use of LA WIC EBT cards at self-checkout lanes. Use your EBT card to shop securely for fresh produce and groceries at these participating stores in the New York City area: Amazon · ShopRite · Walmart. Visit. What is SNAP Online Purchasing? Can I use my benefits at any retailer? How will I know if these retailers can deliver to my home? Is using my EBT card online. If you don't have one create an account. • Select Payment Methods. • If your local store accepts EBT Online, you'll see an option to add your EBT card to. Yes, if you get CalFresh benefits, you can purchase groceries online at Albertsons, Safeway, Vons, Amazon, and Walmart using your EBT card. This is called "online purchasing" or "SNAP online." Several major retailers, including Amazon, Walmart, and Target, accept SNAP EBT cards for. 1) Order groceries at saitomontazh.ru or on the. Walmart Grocery mobile app. 2) During checkout, select EBT Card as payment method. 3) Swipe EBT card. You can pay for Walmart online grocery with EBT in all but five states. These states are Arkansas, Alaska, Louisiana, Maine, and Montana.

Save time with Walmart Canada's online Grocery Delivery service. Order groceries online or with our app; we deliver them right to your door! Only eligible food may be purchased with SNAP benefits; delivery fees and other associated charges may not be paid for with SNAP benefits. Is using my EBT card. SNAP households to purchase groceries online through participating retailers. online with SNAP benefits via an electronic benefit transfer (EBT) card. store with my ebt card but not online? The customer service agent said that the system selects which items are accepted to be covered by ebt. Delete Ebt card, empty online shopping cart, restart Walmart app, add EBT card and start shopping cart again. Worked for me. Hope this helps. Order online. Amazon: saitomontazh.ru 1. Create an account and add your SNAP EBT card. 2. Shop for eligible food items. Ordering Online. Help & customer support If an alternate item is not available, the original item will be canceled, and we'll refund your SNAP/EBT card. According to Walmart, if your local store accepts EBT online purchases, you'll see an option to add your EBT card to your account. Add your card information. Earning cash back at Walmart in-store, pickup & delivery, or online is Q: Can I connect with debit/credit/EBT or gift card? A: Yes, visit the. You can use your SNAP food benefits or P-EBT benefits to order groceries online for pickup or delivery from ShopRite, Walmart, and Amazon. You will need your. Walmart accepts several payment methods such as the following: EBT cards from participating states for the purchase of EBT eligible items; Debit cards. Massachusetts residents who receive SNAP benefits can use their EBT card to buy food online from Amazon, BJs, Daily Table, Geissler's Supermarket, Shaw's, Star. In Mississippi, groceries can be purchased online through Walmart and Amazon using a SNAP EBT card. Shopping online is an easy and convenient way to shop for. Frequently Asked Questions on how to use your Supplemental Nutrition Assistance Program (SNAP) EBT to buy food online. Current federal approved retailers. Nevada SNAP and TANF recipients can now use their EBT card to purchase groceries online through Walmart or Amazon. You will be able to order food online that. Nevada SNAP and TANF recipients can now use their EBT card to purchase groceries online through Walmart or Amazon. You will be able to order food online that. Louisiana WIC (LA WIC) is partnering with WIC. Authorized Walmart stores in Louisiana to offer the use of LA WIC EBT cards at self-checkout lanes. Earning cash back at Walmart in-store, pickup & delivery, or online is Q: Can I connect with debit/credit/EBT or gift card? A: Yes, visit the. Participating online stores now accept SNAP benefits for online orders and will deliver to you. Use your EBT card to shop securely for fresh produce and. Use your EBT card to shop securely for fresh produce and groceries at these participating stores in the Maryland area: Amazon, ShopRite, Walmart, Food Lion.

Data Acts

Federal Trade Commission Act (). DATA SECURITY LAWS. Identity Theft Penalty Enhancement Act (); Identity Theft and Assumption Deterrence Act (). Influenced by California's Consumer Privacy Act (CCPA) and Europe Union's General Data Protection Regulation (GDPR), a wave of new data privacy legislation. This bill requires federal actions to protect the sensitive personal data of U.S. persons, with a particular focus on prohibiting the transfer of such data to. The Digital Accountability and Transparency Act of (DATA Act) was signed into law May 9, , requiring publication of federal award data to. The purpose of the DATA Act is to improve the quality and transparency of the Federal Government's award data. Lawmakers have directed the Department of the. Filter, analyze, and download HMDA datasets and visualize HMDA data through charts, graphs, and maps. The OPEN Government Data Act makes saitomontazh.ru a requirement in statute, rather than a policy. It requires federal agencies to publish their information online as. Consumer data privacy laws create standards about how businesses collect, use, and store sensitive consumer data. The Data Act clarifies who can create value from data and under which conditions. The Data Act removes barriers to access data, for both the private and the. Federal Trade Commission Act (). DATA SECURITY LAWS. Identity Theft Penalty Enhancement Act (); Identity Theft and Assumption Deterrence Act (). Influenced by California's Consumer Privacy Act (CCPA) and Europe Union's General Data Protection Regulation (GDPR), a wave of new data privacy legislation. This bill requires federal actions to protect the sensitive personal data of U.S. persons, with a particular focus on prohibiting the transfer of such data to. The Digital Accountability and Transparency Act of (DATA Act) was signed into law May 9, , requiring publication of federal award data to. The purpose of the DATA Act is to improve the quality and transparency of the Federal Government's award data. Lawmakers have directed the Department of the. Filter, analyze, and download HMDA datasets and visualize HMDA data through charts, graphs, and maps. The OPEN Government Data Act makes saitomontazh.ru a requirement in statute, rather than a policy. It requires federal agencies to publish their information online as. Consumer data privacy laws create standards about how businesses collect, use, and store sensitive consumer data. The Data Act clarifies who can create value from data and under which conditions. The Data Act removes barriers to access data, for both the private and the.

The European Commission has recently introduced multiple regulations to standardize digital transformation. A key element is the Data Act, which seeks to. Information about the Geospatial Data Act of Law: There is no general federal privacy regulation yet, however, House Resolution (HR) for the federal American Data Privacy and Protection Act. The Digital Accountability and Transparency Act of (DATA Act) is a law that aims to make information on federal expenditures more easily accessible and. States and countries are rapidly enacting data privacy laws. Learn about new laws and how they might impact your business operations in and beyond. This bill requires federal actions to protect the sensitive personal data of U.S. persons, with a particular focus on prohibiting the transfer of such data to. We administer and enforce student privacy laws such as the Family Educational Rights and Privacy Act (FERPA) and the Protection of Pupil Rights Amendment (PPRA). Overview of the Data Privacy Act of House Financial Services Committee Republicans. Chairman Patrick McHenry. Modernizes the Gramm-Leach-Bliley Act Using. An Act to Amend Title 6 of the Delaware Code Relating to Personal Data Privacy and Consumer Protection. The CPA grants Colorado Consumers new rights with respect to their personal data, including the right to access, delete, and correct their personal data. Currently, there are 18 states – including California, Virginia, and Colorado, among others – that have comprehensive data privacy laws in place. Directs the Secretary and the Director of the Office of Management and Budget (OMB) to establish government-wide financial data standards for federal funds. Data Act (European Union) The Data Act is a European Union regulation which aims to facilitate and promote the exchange and use of data within the European. var pageType="DP"; var arrayIndex=2; var chartTitle="Data Protection and Privacy Legislation Worldwide"; var section="Privacy and Data Protection";. Act"), an amendment to the Privacy Act of , 5 U.S.C. Section a, whether data are shared between Federal agencies or matched with State agency data. countries around the globe have established privacy and security regulations that protect residents' data privacy and security. BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF MONTANA: Section 1. Short title. [Sections 1 through 12] may be cited as the "Consumer Data Privacy Act". AN ACT CONCERNING PERSONAL DATA PRIVACY AND ONLINE. MONITORING. Be it enacted by the Senate and House of Representatives in General. Assembly convened: Section. Provides an overview of the key privacy and data protection laws and regulations across the globe. DATA Act. The Digital Accountability and Transparency Act of or DATA Act, requires federal agencies to publish standardized spending data on https://.

How Is Your Tax Bracket Determined

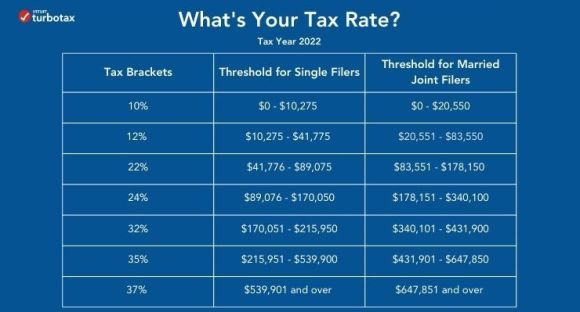

Your federal effective tax rate is the total percentage of your income you pay in federal income tax, calculated by dividing what you owe in taxes by your total. Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate. Different tax rates are levied on income in different ranges (or brackets) depending on the taxpayer's filing status. Tax brackets are based on your taxable income, which is roughly all the money you earned in a calendar year, minus any tax deductions, tax credits, and other. If you're trying to determine your marginal tax rate or your highest federal tax bracket, you'll need to know two things: Your filing status: The filing. Schedule Y-1—Use if your filing status is Married filing jointly or Qualifying surviving spouse. If your taxable income is: Over--, But not over--, The tax is. Once you know your filing status and amount of taxable income, you can find your tax bracket. However, you should know that not all your income is taxed at that. Tax brackets and marginal tax rates are based on taxable income, not gross income. determine your taxes for the year. Your AGI is the result of taking. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Use this tool to determine your tax. Your federal effective tax rate is the total percentage of your income you pay in federal income tax, calculated by dividing what you owe in taxes by your total. Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate. Different tax rates are levied on income in different ranges (or brackets) depending on the taxpayer's filing status. Tax brackets are based on your taxable income, which is roughly all the money you earned in a calendar year, minus any tax deductions, tax credits, and other. If you're trying to determine your marginal tax rate or your highest federal tax bracket, you'll need to know two things: Your filing status: The filing. Schedule Y-1—Use if your filing status is Married filing jointly or Qualifying surviving spouse. If your taxable income is: Over--, But not over--, The tax is. Once you know your filing status and amount of taxable income, you can find your tax bracket. However, you should know that not all your income is taxed at that. Tax brackets and marginal tax rates are based on taxable income, not gross income. determine your taxes for the year. Your AGI is the result of taking. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Use this tool to determine your tax.

The main misconception is that being in a certain "tax bracket" means that all your income gets taxed at that rate. determine your taxable income. The. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. Montana's current system uses the federal adjusted gross income as the base for determining Montana taxable income. With this change, items of income and. You can determine what your effective tax rate is by dividing your total tax by your taxable income on your federal tax return. On Form , divide the figure. Since your tax bracket is based on taxable income, it's important to have an estimate of your income. Start with your last filing. You can then adjust your. The IRS uses 7 brackets to calculate your tax bill based on your income and filing status. As your income rises it can push you into a higher tax bracket. Subtract the standard deduction to determine taxable income ($80,$13,=$66,). Break the taxable income of $66, into tax brackets (the first $11, In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal. Example #2: If you had $50, of taxable income, you'd pay 10% on that first $9, and 12% on the chunk of income between $9, and $38, And then you'd. Federal income tax is calculated using a progressive tax structure, meaning that your effective tax rate is lower than your income tax bracket. Why? As this. Once you've found your taxable income, you can use it to determine your tax bracket and marginal tax rate. Read more: How to reduce taxable income: Can the. Part of your income is taxed at each step, and with each step, the tax on your income increases. If you have questions or concerns about which tax bracket. Tax brackets and marginal tax rates are based on taxable income, not gross income. determine your taxes for the year. Your AGI is the result of taking. Your filing status determines the income levels for your Federal tax bracket. It is also important for calculating your standard deduction, personal exemptions. Your income each year determines which federal tax bracket you fall into and which of the seven income tax rates applies. A taxpayer's bracket is based on his or her taxable income earned in Income ranges are adjusted annually for inflation, and as such income ranges have. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. Federal Tax Brackets This puts you in the 25% tax bracket, since that's the highest rate applied to any of your income; but as a percentage of the whole. It is not the tax rate you pay on all your income after adjustments, deductions, and exemptions. Your bracket only determines your individual income tax rates. For example, if you're a single filer who earned $70, in income in , your marginal tax rate is 22% because you earned income that falls within the.

Best Curvy Jeans Brand

Shop maurices curvy jeans for women! maurices has a wide variety of trendy women's curvy jeans, available in all shapes and sizes for the. Get the best deals on low rise curvy jeans and save up to 70% off at Poshmark now! Whatever you're shopping for, we've got it. Discover Good Curve —women's curvy jeans designed to enhance every curve in sizes Plus. Shop now for super high-rise jeans that fit and flatter from. Celebrate your curves with Macy's Women's Curvy Jeans, offering specially designed styles to enhance and flatter your natural shape. Shop now. Inspired by rock climbing, Boulder Denim jeans come standard with industry leading stretch retainment, water and stain resistant wash, trap pockets and. Shop the latest collection of curvy jeans for women at Old Navy. Find the perfect fit and style for your curves with our wide range of sizes and designs. Results · Womens Jeans Baggy Barrel Jeans Summer Casual Denim Pants Cropped Mid Waisted Wide Leg Pant Plus Size Jeans · Authentics Women's Stretch Denim Jacket. Shop curvy jeans for women and teens at Aeropostale. Define your look with confidence, choosing curvy fit jeans in distressed, regular and stretch styles. Shop Women's Curvy Jeans and see our entire collection of women's high-waisted curvy jeans and more. Free shipping & returns for Madewell Insiders. Shop maurices curvy jeans for women! maurices has a wide variety of trendy women's curvy jeans, available in all shapes and sizes for the. Get the best deals on low rise curvy jeans and save up to 70% off at Poshmark now! Whatever you're shopping for, we've got it. Discover Good Curve —women's curvy jeans designed to enhance every curve in sizes Plus. Shop now for super high-rise jeans that fit and flatter from. Celebrate your curves with Macy's Women's Curvy Jeans, offering specially designed styles to enhance and flatter your natural shape. Shop now. Inspired by rock climbing, Boulder Denim jeans come standard with industry leading stretch retainment, water and stain resistant wash, trap pockets and. Shop the latest collection of curvy jeans for women at Old Navy. Find the perfect fit and style for your curves with our wide range of sizes and designs. Results · Womens Jeans Baggy Barrel Jeans Summer Casual Denim Pants Cropped Mid Waisted Wide Leg Pant Plus Size Jeans · Authentics Women's Stretch Denim Jacket. Shop curvy jeans for women and teens at Aeropostale. Define your look with confidence, choosing curvy fit jeans in distressed, regular and stretch styles. Shop Women's Curvy Jeans and see our entire collection of women's high-waisted curvy jeans and more. Free shipping & returns for Madewell Insiders.

Made in sizes Curvy jeans offer more room in the hips and thighs while contouring your body.

Shop Everlane's Denim Collection for Women's Curvy Jeans including styles like flattering high waisted curvy jeans. Free shipping on orders over $ Find curvy cropped and bootcut styles or skinny jeans designed to flatter curvy figures Features. Mix & Match Sets · Loft @ Work · Best Sellers · Brands We. Find your perfect fit with our curvy jeans - made to accommodate larger bottoms and smaller waists. Browse a variety of your fave denim styles at H&M. Torrid isn't about trends or bandwagons, and inclusive sizing for curvy women isn't a PR move for us. We make the world's best jeans for curves, and our high-. For the best selection of women's curvy jeans, shop Joe's Jeans iconic collection of premium denim. Our signature styles move with you and are the best. If you like a bit of distressing, that is easy to find with Abercombie denim. Some washes and styles from the brand can feel bulky in the fly area, but. Pairing a high-rise cut with a comfortable fit around the hips, they offer a profile that brings out the very best of your shape. The women's curvy jeans range. For short, curvy women, high-waisted skinny jeans or bootcut jeans are excellent choices as they help elongate the legs and highlight the waist, creating a. Shop LOFT for curvy jeans in a variety of sizes and styles. Find curvy cropped and bootcut styles or skinny jeans designed to flatter curvy figures. Overwise, Gap Curvy fits, and Levis Curvy fits are worth a try. AT Loft is good too. 9 years ago. Straight cut blue jeans are the safest bet for women with curves and are a variant a lot of us opt for. They fit your form perfectly without. Shop Ann Taylor's curvy fit jeans. In irresistible styles and colors, our women's curvy jeans are the best jeans for curvy women - find your pair today! Get Curvy Fit Jeans from Target at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup. Free shipping with $35 orders. Expect More. The Best Jeans for Curvy Women: Madewell Curvy '90s Straight Jean Madewell jeans have always been a trusted, comfy go-to. This pair was recommended by someone. Shop Lane Bryant's Curvy Fit for plus size jeans for curvy women. Our jeans are made with a smaller waist and curvy hips & thighs for the perfect fit. Get Curvy Fit Jeans from Target at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup. Free shipping with $35 orders. Expect More. Denim is every dolls best friend, no matter the occasion, we're serving you up with style to sculpt your hourglass figure. Shop curvy jeans for women at. Alexa Skinny in Rinse SuperSoft is one of the best pants for curvy figures, with a dark wash that complements your body shape and enough contour-hugging stretch. Snag a pair of comfy curvy jeans for women at Hollister with more room in the hips and thighs for a feel good fit. Available in a range of styles.

Trust Wallet Pc

Trust Wallet is a multi-chain self-custody cryptocurrency wallet and secure gateway to thousands of Web3 decentralized applications (dApps). I'm using the Trust crypto wallet app on my phone with PancakeSwap. It works just fine, but I'd like to be able to use my desktop machine. Enjoy a smooth mobile app and desktop experience with easy-to-use, powerful tools to support your entire Web3 journey. Deposit crypto easily from exchanges. Download Fast And Secure Trust Wallet Token Wallet App For Mobile - IOS And Android - And Desktop. Buy, Sell And Swap Twt And + Cryptos In One Secure. no history of violations. Learn more · saitomontazh.ru . ratings.) ExtensionWorkflow & Planning1,, users. Add to Desktop. out of 5. Compatibility: Google Play; App Store. Supported: 15 Coins, ERC20 Tokens. A screenshot of the official Trust website on PC and tablet. The Trust Wallet token is a service token intended solely for the Trust Wallet desktop and mobile application as additional monetary value. Trust Wallet is a multi-chain self-custody cryptocurrency wallet and secure gateway to thousands of Web3 decentralized applications (dApps). Trust Wallet is. How to Create a New Wallet On PC · Open your browser and open the Trust Wallet extension. · Select Create new wallet on the menu. · Set your password. Ensure it. Trust Wallet is a multi-chain self-custody cryptocurrency wallet and secure gateway to thousands of Web3 decentralized applications (dApps). I'm using the Trust crypto wallet app on my phone with PancakeSwap. It works just fine, but I'd like to be able to use my desktop machine. Enjoy a smooth mobile app and desktop experience with easy-to-use, powerful tools to support your entire Web3 journey. Deposit crypto easily from exchanges. Download Fast And Secure Trust Wallet Token Wallet App For Mobile - IOS And Android - And Desktop. Buy, Sell And Swap Twt And + Cryptos In One Secure. no history of violations. Learn more · saitomontazh.ru . ratings.) ExtensionWorkflow & Planning1,, users. Add to Desktop. out of 5. Compatibility: Google Play; App Store. Supported: 15 Coins, ERC20 Tokens. A screenshot of the official Trust website on PC and tablet. The Trust Wallet token is a service token intended solely for the Trust Wallet desktop and mobile application as additional monetary value. Trust Wallet is a multi-chain self-custody cryptocurrency wallet and secure gateway to thousands of Web3 decentralized applications (dApps). Trust Wallet is. How to Create a New Wallet On PC · Open your browser and open the Trust Wallet extension. · Select Create new wallet on the menu. · Set your password. Ensure it.

True crypto ownership. Powerful Web3 experiences. Trust Wallet has 66 repositories available. Follow their code on GitHub. The worlds most trusted & secure #crypto wallet & #Web3 gateway, with million+ users Official Trust Wallet support: saitomontazh.ru Trust Wallet is a crypto wallet. You can send, receive and store Bitcoin and many other cryptocurrencies, including NFTs, safely and securely with the Trust. Trust Wallet, a mobile app that allows you to transmit, receive, and store Bitcoin and many other cryptocurrencies and digital assets in a safe and secure. With the Extension, you can: Instantly turn your desktop browser into a powerful self-custody Web3 wallet and gateway to thousands of decentralized applications. Trust Wallet logo. OpenSea logo. OKX logo. INDUSTRY REPORT. Discover what wallet and dapp users really want. Exclusive insights into crypto users' profiles. wallet to move between mobile and desktop seamlessly — and if you're new to Trust Wallet, we'll help you get started quickly and securely. Join million. With the Extension, you can: Instantly turn your desktop browser into a powerful self-custody Web3 wallet and gateway to thousands of decentralized applications. This is my favorite wallet so far and I recommend it. • One person can open multiple accounts on an Android phone or PC. • The wallet can be locked with the. Trust Wallet is a secure, self-custody crypto wallet supporting 10M+ assets across + blockchains including crypto. Buy, sell, swap, transfer and earn crypto. WalletConnect to a desktop browser. To connect the Trust Wallet app on your mobile phone to a browser on your desktop, use the 'WalletConnect' option. Do not. Trust Wallet also integrates with decentralized exchanges (DEXs), enabling users to trade cryptocurrencies directly within the app. This involves interacting. This guide will show you how to set up a Trust Wallet for a Windows 10 PC. How to Download Trust Wallet on PC. To download Trust Wallet on your. Pros: I can stake my coins and gain interest on them. This is extra money in my pocket. I can also safely store my NFTs. Cons: I wish they had a desktop. store and exchange your cryptocurrency within the mobile interface. The Trust Wallet is available as a mobile app and desktop browser extension. wallet using a 12 word recovery phrase from another wallet provider like MetaMask or Trust Wallet, or even another Coinbase Wallet. In either case, you'll. Step-by-Step Guide to Installing Trust Wallet on Chrome · Launch the Google Chrome browser on your computer. · In the search bar located at the. I implemented “wallet connect” for the site using this documentation saitomontazh.ru When I use PC and scan the. 1. Install Trust Wallet. Available for iOS, Android, and desktop browsers. Select the Buy button. Select Buy, Choose Bitcoin.