saitomontazh.ru

Tools

Commercial Loans With Bad Credit

/cloudfront-us-east-1.images.arcpublishing.com/dmn/VQTVMZKYXBBLVECIAWNZC46WME.jpg)

When you have poor or bad credit, finding a lender can be difficult, but there are many loan options available with credit scores as low as This includes. Bad credit business loans can be the perfect solution, and are often the only source of funding that businesses with poor credit can turn to for help. Bad. Types of Bad Credit Business Loans. Types of business loans for poor credit offered by alternative lenders include: Short-Term Small Business Loans. A short-. A poor credit history doesn't necessarily mean you can't qualify for loans. Business lines of credit for bad credit can be a viable way to access cash. Regarding standard loan options, business owners with low credit may qualify for short-term loans, which may be appropriate if you need funding for more. Credibly offers short-term working capital loans for bad credit, as well as equipment financing and invoice factoring for businesses with poor credit. Lines of. Even those with bad credit may qualify for startup funding. The lender will provide you with a full list of eligibility requirements for your loan. Be a for. Who Qualifies for a Bad Credit Business Loan? Anyone with low credit score can apply for a bad credit business loan. As long as your business has a steady. Below you'll find some resources on how to improve your odds of getting approved for a loan with poor credit. The Basics of Bad Credit Business Loans. Lenders. When you have poor or bad credit, finding a lender can be difficult, but there are many loan options available with credit scores as low as This includes. Bad credit business loans can be the perfect solution, and are often the only source of funding that businesses with poor credit can turn to for help. Bad. Types of Bad Credit Business Loans. Types of business loans for poor credit offered by alternative lenders include: Short-Term Small Business Loans. A short-. A poor credit history doesn't necessarily mean you can't qualify for loans. Business lines of credit for bad credit can be a viable way to access cash. Regarding standard loan options, business owners with low credit may qualify for short-term loans, which may be appropriate if you need funding for more. Credibly offers short-term working capital loans for bad credit, as well as equipment financing and invoice factoring for businesses with poor credit. Lines of. Even those with bad credit may qualify for startup funding. The lender will provide you with a full list of eligibility requirements for your loan. Be a for. Who Qualifies for a Bad Credit Business Loan? Anyone with low credit score can apply for a bad credit business loan. As long as your business has a steady. Below you'll find some resources on how to improve your odds of getting approved for a loan with poor credit. The Basics of Bad Credit Business Loans. Lenders.

The success of your application will depend on the original cause of the poor credit rating. Bad Credit Business Loans. Regardless of your low credit scores. Simple application. Simple process. Bad credit business loans made easy. Do not let a poor credit score prevent you. Golden Valley Bank partners with the Small Business Administration to offer loan solutions with low interest rates and decreased down-payment options. 2. Cash Flow Financing Credit Suite's Cash Flow Financing addresses the needs of entrepreneurs with bad credit. With Cash Flow Financing, entrepreneurs can. Some business loan products can come with low credit score requirements or may be well suited for business owners with poor credit. You should always check for. Bad Credit Business Loans in USA. If your poor credit history is preventing you from obtaining financing from traditional lenders, we're here to tell you that. Bad Credit Business Loans in USA. If your poor credit history is preventing you from obtaining financing from traditional lenders, we're here to tell you that. SBA loan for an existing business but low credit score? · credit score minimum · 10% equity infusion is required for a full change in. How To Get a Small Business Loan With Bad Credit (In 4 Easy Steps) · 1. Research Business Loans For Poor Credit · 2. Understand Your Lender's Conditions · 3. Read on to find our the best bad credit business loans of June, Have bad credit? Apply for a small business loan with Excel Capital with no to low credit. CREFCOA provides commercial loans for borrowers with bad credit under our equity based programs. Borrowers with bankruptcy, foreclosure, short sale, tax liens. Bad Credit Business Loans: What You Need to Know · For every business owner with a low credit score, the notion of a bad credit business loan immediately invokes. The primary advantage of small business loans for bad credit is accessibility. A poor credit score won't prevent you from being approved as long as your. A bad credit business loan enables business owners with a poor business or personal credit score to access the finance they need to trade or grow. Business loans with bad or poor credit do not offer guaranteed approval, just like having good credit doesn't offer guaranteed approval, but we have a vast. Assess your financial situation: Determine if your current financial standing warrants taking on additional debt and whether a poor credit business loan is the. Get low-rate business funding, even with bad credit. Quick online application and same-day funds. No collateral needed for credit scores over Bad credit is a FICO score that falls below , which is a fair or poor credit score. You typically need a FICO score of at least to qualify for a bad. It may be possible to get a small business loan for your startup with bad credit, and a poor credit score is considered a FICO® score of or less. Business loans can be difficult to secure if you have bad credit. Here are financing options for businesses with poor credit history.

Pros And Cons Of Gerber Life Insurance

To give you an idea of cost, a $,, year Gerber Life Term Life policy costs as little as $ a month for a healthy year-old female paying by. Gerber Life Insurance Pros & Cons · Offers life insurance policies that don't require medical exams. · Life policy terms of up to 30 years. · Strong financial. Spoiler alert: the Gerber Grow-Up Plan is very expensive life insurance that gobbles up your money and “buys your child the option” to purchase even more. Employees also rated Gerber Life out of 5 for work life balance, for culture and values and for career opportunities. What are the pros and cons. Gerber's grow up plan. is basically their children's whole life policy. The depth benefit, which is the face value, is from 10, to 50, dollars. And it. Pros and Cons of Buying Life Insurance for a Child · Children are less likely to die young and necessitate a death benefit; therefore, your money may be better. Pros: Customers can save 10% when they sign up for automatic payments. Death benefit on a child's policy doubles when they turn Cons: Limited. Life insurance for children provides lower rates, lifelong coverage, potential additional coverage, and help with final expenses, but requires a long-term. In addition to the reliable coverage that Gerber Life provides, you can rest assured that your policy's premium will never change for any reason unless you stop. To give you an idea of cost, a $,, year Gerber Life Term Life policy costs as little as $ a month for a healthy year-old female paying by. Gerber Life Insurance Pros & Cons · Offers life insurance policies that don't require medical exams. · Life policy terms of up to 30 years. · Strong financial. Spoiler alert: the Gerber Grow-Up Plan is very expensive life insurance that gobbles up your money and “buys your child the option” to purchase even more. Employees also rated Gerber Life out of 5 for work life balance, for culture and values and for career opportunities. What are the pros and cons. Gerber's grow up plan. is basically their children's whole life policy. The depth benefit, which is the face value, is from 10, to 50, dollars. And it. Pros and Cons of Buying Life Insurance for a Child · Children are less likely to die young and necessitate a death benefit; therefore, your money may be better. Pros: Customers can save 10% when they sign up for automatic payments. Death benefit on a child's policy doubles when they turn Cons: Limited. Life insurance for children provides lower rates, lifelong coverage, potential additional coverage, and help with final expenses, but requires a long-term. In addition to the reliable coverage that Gerber Life provides, you can rest assured that your policy's premium will never change for any reason unless you stop.

Cons. Horrible bonus structure. Was this review helpful? Yes3There are 3 I have enjoyed my employment at Gerber Life Insurance and feel welcomed. Gerber life insurance will be a great choice for those searching for whole-life insurance for a child or teenager. Life coverage guidelines. pros and cons of owning numerous policies carefully before committing. Get Insurance Company, National Integrity Life Insurance Company or Gerber Life. Gerber Life Insurance provides affordable policies for all ages. Learn about our family life insurance policies and protect your loved ones today! A+ (Superior) AM Best rating · Unique grow-up and college plans for children · No-medical-exam options for term policies · Broad range of life insurance products. Pros. Development and career opportunities. Chance to work with amazing associates and leadership. Cons. I. When it comes to the plan itself, the Gerber Life Insurance Company's Guaranteed Life Plan is a fairly typical policy in terms of features and benefits. What. Grandmother and grandson sitting together on couch at home spending time playing, embracing, and · Adult Life Insurance. The Pros and Cons of Term Life and. A Gerber Life convertible term life insurance policy makes switching to a whole life policy much easier. Since you already own a term life policy, you're not. Gerber Life offers several products that won't make sense for most families, such as child life insurance and endowment insurance, along with overpriced term. Great question. · Gerber life has been the leading insurer for Juvenile life insurance policies ever since I can remember. · Buying a life policy. In this post, we'll look at the advantages and drawbacks of taking a gap year between high school and college. Provides lifelong coverage with fixed premiums and builds cash value over time. Guaranteed Life Insurance, Offers life insurance for adults aged Traditional life policies pay for sickness and accident while the Gerber Accidental Death and Dismemberment life insurance only pays for death or injury caused. The cash value of your policy is the accumulated amount of money that Gerber Life sets aside each time you pay your premium after the initial policy years. Gerber Life Insurance offers three whole life insurance policies for kids and whole and term life insurance coverage options for adults. Gerber Life has received an “A” (Excellent) rating from A.M. Best, an independent rating agency. A.M. Best rated Gerber Life on its financial stability. Gerber's whole life insurance policy is a good option for lifelong coverage and a way to build cash value over time. However, it may not be best for those. That's why it's important to understand the pros and cons of employer life Gerber Life Term Life Insurance coverage is easy to get. The application.

Tax On Bonus Payments

Bonuses count as additional income, which means a higher tax rate applies than standard wages. Bonus income is typically subject to a 22% federal bonus tax. How are they taxed? In terms of taxation, employee bonuses are subject to Income Tax. This is deducted at source by the employer. The rate of Income Tax that. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Therefore the annual tax is being calculated ONLY on the bonus amount. Don't forget, 99% of the time your bonus payments will likely be BELOW the employees. 2- How do I know what my annual RRSP contribution limit is? Your RRSP deductible limit is indicated in line (A) of your Notice of Assessment in your income tax. The flat rate method, also known as the flat percentage method, requires you to withhold income tax at a flat 22 percent rate. For example, say you're giving. Yes, bonuses are considered supplemental wages and therefore are taxable. As defined by the Internal Revenue Service (IRS) in the Employer's Tax Guide. What is the bonus tax rate for ? · The flat withholding rate for bonuses is 22% — except when those bonuses are above $1 million. · If your employee's bonus. Bonuses count as additional income, which means a higher tax rate applies than standard wages. Bonus income is typically subject to a 22% federal bonus tax. Bonuses count as additional income, which means a higher tax rate applies than standard wages. Bonus income is typically subject to a 22% federal bonus tax. How are they taxed? In terms of taxation, employee bonuses are subject to Income Tax. This is deducted at source by the employer. The rate of Income Tax that. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Therefore the annual tax is being calculated ONLY on the bonus amount. Don't forget, 99% of the time your bonus payments will likely be BELOW the employees. 2- How do I know what my annual RRSP contribution limit is? Your RRSP deductible limit is indicated in line (A) of your Notice of Assessment in your income tax. The flat rate method, also known as the flat percentage method, requires you to withhold income tax at a flat 22 percent rate. For example, say you're giving. Yes, bonuses are considered supplemental wages and therefore are taxable. As defined by the Internal Revenue Service (IRS) in the Employer's Tax Guide. What is the bonus tax rate for ? · The flat withholding rate for bonuses is 22% — except when those bonuses are above $1 million. · If your employee's bonus. Bonuses count as additional income, which means a higher tax rate applies than standard wages. Bonus income is typically subject to a 22% federal bonus tax.

Bonuses are taxed as part of your total income. For many people that means the correct amount of tax is 22%. Employers withhold an estimate of. The Viventium bonus calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments, such as bonuses. To use this bonus tax calculator, simply input the bonus amount and the tax filing status. Gross Pay YTD. Exempt from. Federal. Yes, No. FICA. Yes, No. Bonus. Total bonus payments made by employers to their employees in a year of assessment are taxed at 5% up to 15% of the annual basic salary of the employee. Bonuses up to $1 million are taxed at a flat 22%, while any bonus more than $1 million is taxed at 37%. The bonus tax withholding rate is a flat 22% as long as the amount paid is under $1 million. If it's over that amount, the bonus tax rate jumps to 37%. Keep in. Bonuses are ordinary income just like wages and taxed at exactly the same rate. However they can be withheld at a different rate depending on. The percentage method is the simpler of the two and involves a flat tax rate of 22% on bonuses up to $1 million, as of the current tax laws. This method is. This calculator uses supplemental tax rates to calculate withholdings on special wage payments such as bonuses. There is no wage base limit for Medicare saitomontazh.ru security and Medicare taxes apply to the wages of household workers you pay $2, or more in cash wages in. Below is a free aggregate bonus calculator to calculate this tax in a few clicks. Simply enter your employee's gross bonus amount, along with their regular. If you choose to pay a bonus as part of a normal paycheck, you'll treat the total of the regular wages and supplemental wages as a single payment for tax. Do you have to pay taxes on bonuses? Yes. Here's what you should know about claiming a bonus on your tax return, including how to lower your bonus tax. In the tax year, the federal flat tax rate for bonuses is 22%. On top of that 22%, you'll need to deduct the typical Social Security and Medicare taxes . With this tax method, the IRS taxes your bonus at a flat-rate of 25 percent, whether you receive $, $ or $50 — however, if your bonus is more than $1. The amount an employee's bonus is taxed depends on their tax bracket and what withholding method the employer chooses to implement. There are two approaches a. A bonus is a taxable event, but it is most importantly something to plan properly for, so that it does not get sucked up into your lifestyle spending, and. Bonuses declared at year-end create the opportunity for a personal tax deferral since the amount does not need to be paid for 6 months. · Can often be directly. As with standard wages, the Social Security tax rate on bonuses is % on the first $, you pay each of your employees. Likewise, the Medicare. Under this approach, your employer withholds 22% of your bonus for federal income tax purposes. For example, let's say you received a $1, bonus in your next.

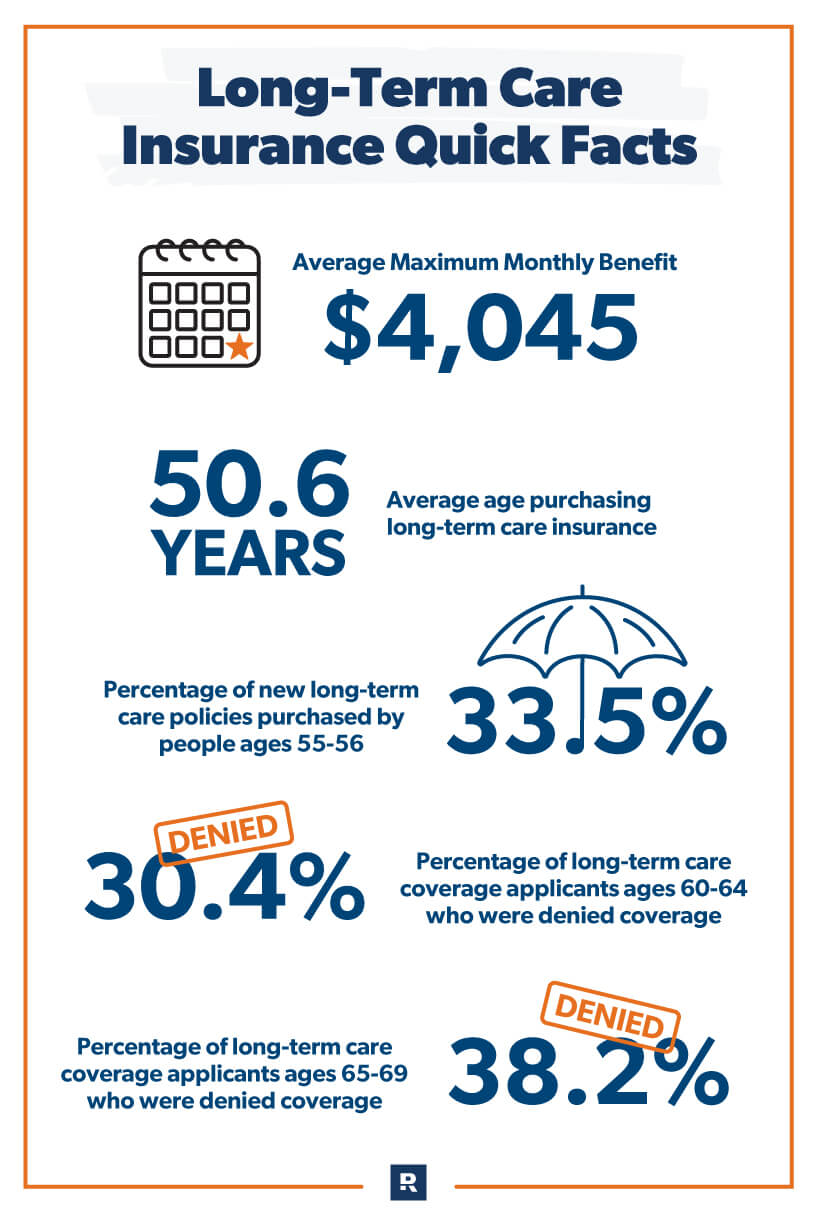

Selectquote Long Term Care Insurance

Want to know how much your insurance would cost? Get a free quote on life, auto, home, or Medicare insurance through SelectQuote today! Pacific West Insurance Group provides Group Long-Term Care (LTC) Insurance for Las Vegas and all of Nevada. Long Term Care insurance helps you be more prepared for the financial consequences of the costs of home care, assistive living, or nursing home facilities. Insurance Quote. Insurance Quotes. Name*. Email*. Phone (optional). Select Type of Insurance*. Personal; Business; Life & Financial; Benefits. Select Quote*. health insurance policy providing long-term care insurance. The acceleration of death benefits is intended to qualify for favorable tax treatment under the. longer enrolled in a medical plan through the SelectQuote Senior exchange, or. - If you are the eligible dependent of a BSA retiree or Long-Term Disability Plan. Looking for affordable, same-day life insurance? SelectQuote can help. Our no medical exam life insurance offers budget-friendly, fully underwritten rates. long-term care, in general, Medicare does not provide benefits. Medicare SelectQuote Senior Insurance Services is a division of SelectQuote Insurance Services. Shop term life insurance policies for as low as $18/month. In just minutes, we can compare term life insurance policies from multiple carriers. Want to know how much your insurance would cost? Get a free quote on life, auto, home, or Medicare insurance through SelectQuote today! Pacific West Insurance Group provides Group Long-Term Care (LTC) Insurance for Las Vegas and all of Nevada. Long Term Care insurance helps you be more prepared for the financial consequences of the costs of home care, assistive living, or nursing home facilities. Insurance Quote. Insurance Quotes. Name*. Email*. Phone (optional). Select Type of Insurance*. Personal; Business; Life & Financial; Benefits. Select Quote*. health insurance policy providing long-term care insurance. The acceleration of death benefits is intended to qualify for favorable tax treatment under the. longer enrolled in a medical plan through the SelectQuote Senior exchange, or. - If you are the eligible dependent of a BSA retiree or Long-Term Disability Plan. Looking for affordable, same-day life insurance? SelectQuote can help. Our no medical exam life insurance offers budget-friendly, fully underwritten rates. long-term care, in general, Medicare does not provide benefits. Medicare SelectQuote Senior Insurance Services is a division of SelectQuote Insurance Services. Shop term life insurance policies for as low as $18/month. In just minutes, we can compare term life insurance policies from multiple carriers.

The cost of term life insurance is determined by a number of factors, including things such as term length, coverage amount, age, gender, health, and lifestyle. saitomontazh.ru Term-Quote () saitomontazh.ru saitomontazh.ru Long Term Disability Insurance. CNA. While your age and health can affect your options, your benefits counselor can help you determine what coverage is right for you. Term Life, Whole Life. Key. *Term rates are based on a year, $, term life insurance policy for men and women in excellent health from one or more of the trusted insurance carriers. Sample rates provide a general idea for possible costs and benefit amounts. Your rate will vary based on your age, health, benefits selected, and other factors. By putting a plan in place to cover expenses that would occur in the event of your death, you can help secure their long-term financial future. These funds can. policies directly to consumers; competition from government-run health Long-term target Adj. EBITDA Margin. Highly attractive financial profile. Fill the gaps in your existing Medicare Advantage plan with ancillary products from recognized insurance carriers. Get your free, no obligation quote today. Changes in family status affecting benefits (marriage, divorce, birth or adoption, etc.) Life insurance beneficiary changes; Retirement benefits; Continuing. This type of policy is also known as instant life insurance and allows you to bypass the medical exam in favor of a convenient online application process. SelectQuote Insurance Services, San Francisco, California. likes. We've been making shopping for insurance easy for nearly 40 years. SelectQuote is a leading technology-enabled, direct-to-consumer distribution platform for insurance products and healthcare services. Through SelectRx, its closed-door, long-term care pharmacy, SelecctQuote provides simple solutions for prescription drug management and support with a. Selectquote offers a variety of services including term life, long-term care, disability income, Medicare supplement and supplemental health insurance. long-term care options. If you're trying to decide which is right for you or a loved one, here's what you need to know: https: //saitomontazh.ruquote. Over 37 million people in the United States have type 2 diabetes, which is a long-lasting health condition that affects how your body turns food into energy. Benefits; health and K, It's not just a job, Its a healthy working environment with like minds, it's a great career for long term. Advancement, career. Most policies are medically underwritten, which means you have to answer health questions and get a medical exam. "Guaranteed acceptance" policies don't ask. Full-time employees are eligible for medical, dental, vision, voluntary short-term disability,company-paid long term disability, company-paid life insurance. long-term pharmacy care; and population health that helps members understand the benefits available under their health plans, and contracts with insurance.

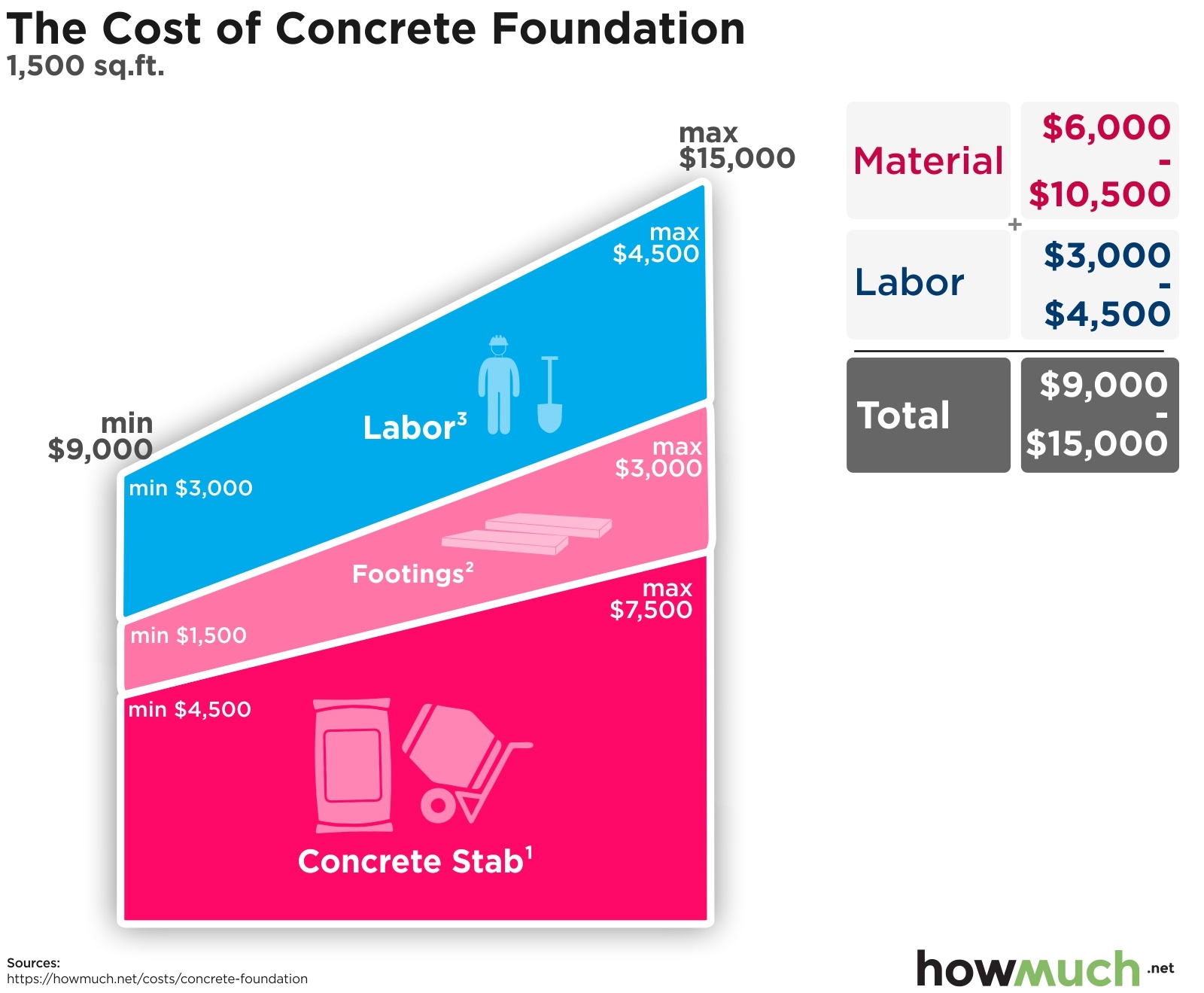

How Much Does It Cost To Lay Concrete Foundation

8 yards x $ per yard = $ $ per yard includes taxes, additives, and unexpected expenses. Double the concrete cost for concrete misc. Once we've added all the materials and labour, a concrete foundation (slab) for a stand-alone house can cost anywhere from $ to $ per square metre. On top. Average cost to raise a concrete foundation is about $ Find here detailed information about concrete foundation costs. What About Labor Costs? · Around $45 per hour to pour the concrete. You may also have to pay a delivery fee (usually around $$60). · About $ per square. Spray-on concrete is the most affordable type of concrete that costs in a range from $50 to $75 per m2. Plain concrete follows with the prices from $60 to $ For a 40×60 slab (2, square feet), this range suggests a total cost between $9, and $19, – **Additional Expenses**: For more complex foundations that. Concrete appears to be about $ CAD (Approx $ USD) per cubic metre in the region. I can crunch the numbers and come up with a reasonable. Concrete Price Considerations - Cost of Concrete · The nationwide concrete cost ranges between $ and $ or more per cubic yard. · The average ready mix price. Generally, the cost of laying a new foundation for a small home is around $5,, while for a larger home, it can reach as high as $40,+. On average, the. 8 yards x $ per yard = $ $ per yard includes taxes, additives, and unexpected expenses. Double the concrete cost for concrete misc. Once we've added all the materials and labour, a concrete foundation (slab) for a stand-alone house can cost anywhere from $ to $ per square metre. On top. Average cost to raise a concrete foundation is about $ Find here detailed information about concrete foundation costs. What About Labor Costs? · Around $45 per hour to pour the concrete. You may also have to pay a delivery fee (usually around $$60). · About $ per square. Spray-on concrete is the most affordable type of concrete that costs in a range from $50 to $75 per m2. Plain concrete follows with the prices from $60 to $ For a 40×60 slab (2, square feet), this range suggests a total cost between $9, and $19, – **Additional Expenses**: For more complex foundations that. Concrete appears to be about $ CAD (Approx $ USD) per cubic metre in the region. I can crunch the numbers and come up with a reasonable. Concrete Price Considerations - Cost of Concrete · The nationwide concrete cost ranges between $ and $ or more per cubic yard. · The average ready mix price. Generally, the cost of laying a new foundation for a small home is around $5,, while for a larger home, it can reach as high as $40,+. On average, the.

On average, some areas can cost as low as $50 for pouring a by slab of concrete. Otherwise, inclusive of materials and installation, a by patio will. For a 40×60 slab (2, square feet), this range suggests a total cost between $9, and $19, – **Additional Expenses**: For more complex foundations that. Arkansas Concrete Costs & Prices ; Cost of Concrete Foundation Installation in Arkansas. $ per square foot (4 inch reinforced slab on grade) (Range: $ -. What About Labor Costs? · Around $45 per hour to pour the concrete. You may also have to pay a delivery fee (usually around $$60). · About $ per square. In general, a slab foundation is the cheapest option, costing around $5 per square foot. A no-basement foundation, or pre-slab, can cost a bit. Mudjacking for sinking foundation repair cost is around $ to $ and involves pouring concrete beneath the foundation to push it back up. The method is. The average cost of a concrete slab (6 inches thick) is about $ per square foot, including both materials and labor. However, the price can go up to $9. Basement foundation cost · Average cost per square foot: $33 · Average cost for full slab foundations: $26, – $50, An owner-builder[4] reports spending $ on excavation, $7, to pour concrete footings and foundations, $1, for flatwork concrete, $1, for sub-rough. The typical concrete patio is approximately sq ft and costs an average of $2, (about $10 per sq ft); depending on a variety of factors, your cost. The average cost of foundations is $9,, ranging between $4, and $14, Foundation costs are influenced by location, size of home, foundation type, and. The average labor prices to build a basement foundation fall between $7 and $10 a saitomontazh.ru This includes framing, troweling, edging, pouring, and excavation. install a concrete pad, along with per unit costs and material requirements. See professionally prepared estimates for concrete pad installation work. The. Cost of Concrete Foundation Installation in California. $ per square foot (4 inch reinforced slab on grade) (Range: $ - $) ; Cost of Concrete Patio. $4,–$6, to pour a slab for a small shed (6m x 7m – 6m x 9m). $10, – $14, for a medium sized shed (7m x 14m). $15, – $22, Foundations cost $4 to $20 per square foot, averaging about $9 per square foot. Slabs run $4 to $7 per square foot, compared to $6 to $15 per square foot for a. You can estimate an average cost of $ – $ per square foot to have a regular concrete floor slab poured. Thus, if you require a more accurate number of. Average cost to install concrete patio is about $ ( saitomontazh.ru concrete patio slab). Find here detailed information about concrete patio costs. In April the cost to Set Concrete Formwork starts at $ - $ per square foot*. Use our Cost Calculator for cost estimate examples customized to the. Homeowners report spending $14, to $44, or an average of $ per square foot to pour their basement foundation and walls. Residential Concrete Cost.

Cummins Hydrogenics Stock

Cummins traded at $ this Monday September 9th, increasing $ or percent since the previous trading session. Looking back, over the last four weeks. On Sept. 9, , Cummins Inc. (NYSE: CMI) announced that it had closed on the previously announced cross-border acquisition of fuel cell and hydrogen. Cummins Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Fuel Cells Stocks ; CMI CUMMINS · ; PLUG PLUG POWER · ; BLDP BALLARD POWER SYSTEMS · Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when. BLDP. Ballard Power Systems. $ $ (%) ; FCEL. Fuelcell Energy. $ $ (%) ; LIN. Linde. $ $ (%) ; CMI. Cummins. $ What Is the Hydrogenics Corporation Stock Price Today? The Hydrogenics Corporation stock price today is What Is the Stock Symbol for Hydrogenics. Explore Accelera electric and hydrogen technologies and solutions that integrate into commercial transportation and industrial processes to eliminate. The Cummins Inc stock price today is What Is the Stock Symbol for Cummins Inc? The stock ticker symbol for Cummins Inc is CMI. Is CMI the Same as $CMI? Cummins traded at $ this Monday September 9th, increasing $ or percent since the previous trading session. Looking back, over the last four weeks. On Sept. 9, , Cummins Inc. (NYSE: CMI) announced that it had closed on the previously announced cross-border acquisition of fuel cell and hydrogen. Cummins Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Fuel Cells Stocks ; CMI CUMMINS · ; PLUG PLUG POWER · ; BLDP BALLARD POWER SYSTEMS · Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when. BLDP. Ballard Power Systems. $ $ (%) ; FCEL. Fuelcell Energy. $ $ (%) ; LIN. Linde. $ $ (%) ; CMI. Cummins. $ What Is the Hydrogenics Corporation Stock Price Today? The Hydrogenics Corporation stock price today is What Is the Stock Symbol for Hydrogenics. Explore Accelera electric and hydrogen technologies and solutions that integrate into commercial transportation and industrial processes to eliminate. The Cummins Inc stock price today is What Is the Stock Symbol for Cummins Inc? The stock ticker symbol for Cummins Inc is CMI. Is CMI the Same as $CMI?

Real-Time News, Market Data and Stock Quote for CUMMINS. Hydrogenics Corporation. Cummins acquired Hydrogenics in , adding key. Cummins pays a meaningful dividend of %, higher than the bottom 25% of all stocks that pay dividends. Dividend Growth. Cummins has been increasing its. Refueling a fuel cell power module with hydrogen is similar to refueling a diesel engine vehicle. Rolling stock OEMs trust Accelera's hydrogen fuel. Cummins Closes on its Acquisition of Hydrogenics 09/09/ - Hydrogenics Corporation - HYGS Stock Chart Technical Analysis for Why Cummins Stock Jumped % in July Despite Dismal Earnings. Cummins' focus on future technologies like hydrogen and fuel cells has caught investor. Explore Authentic Hydrogenics Stock Photos & Images For Your Project Or Campaign. Less Searching, More Finding With Getty Images. At the end of , Cummins acquired Hydrogenics to extend its capabilities in hydrogen fuel cells and develop new production technologies. Powerhouse Energy. Hydrogenics in its US$ million sale to Cummins Inc. Fuel Cells Stocks ; CMI CUMMINS · ; PLUG PLUG POWER · ; BLDP BALLARD POWER SYSTEMS · Research Cummins' (NYSE:CMI) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. Cummins Inc. designs, manufactures, distributes and services diesel, natural gas, electric and hybrid powertrains and powertrain-related components. Cummins (CMI) ; 3 Up-and-Coming Hydrogen Stocks to Put on Your Must-Buy List · Tyrik Torres · Sep 3, ; The 3 Best Manufacturing Stocks to Buy in August · Josh. Key Insights Cummins' estimated fair value is US$ based on 2 Stage Free Cash Flow to Equity With US$ share price. 09, -- Hydrogenics Corporation (NASDAQ: HYGS; TSX: HYG) (the “Company (“Cummins”) acquired all of the outstanding common shares of the Company. Hydrogenics Corporation operates as a subsidiary of Cummins Inc All stock prices are updated at the end of the day. Under the transaction, Cummins Inc. will acquire million shares of Hydrogenics Corporation in exchange for class B common shares in the capital of a. At the end of , Cummins acquired Hydrogenics to extend its capabilities in hydrogen fuel cells and develop new production technologies. Powerhouse Energy. As rail accelerates along its decarbonisation journey, Cummins is working with rolling stock OEMs worldwide to transition to the fuel cell–powered trains that. The institutional investor owned 4, shares of the companys stock Zolmax. 1 year ago. International Assets Investment Management LLC raised its position. Hydrogenics Corp. Ticker Symbol: HYGS* CUSIP: Previous CUSIP (“Cummins”) acquired all of the outstanding common shares of the Company.

Creating Passive Income With Stocks

To receive monthly passive income, consider dividend-paying stocks, REITs, or bond funds, as they often provide regular payouts. Money market. Arrived is a platform for easily investing in Real Estate, starting from $ Invest in rental properties, earn passive income, and let Arrived take care. Learn how passive income strategies — like REITs, dividend stocks and high-yield savings accounts — can potentially boost your income. This means a steady source of passive income, on top of appreciation. There are tax advantages to being a landlord as well. Creating an LLC for your holdings. Ready to earn some passive income? Here are the basics of creating regular cash flows from investments without breaking (too much of) a sweat. Sources · Deposits · Stocks · Bonds · Rental income and royalties · Digital products. Learn how passive income strategies — like REITs, dividend stocks and high-yield savings accounts — can potentially boost your income. Creating passive income streams takes time, money or both. For instance, you could invest money into income-generating assets like dividend-paying stocks. What I do is building a growth portfolio with individual stocks. Also building a dividend portfolio with 50/50 decent yield to reinvest and. To receive monthly passive income, consider dividend-paying stocks, REITs, or bond funds, as they often provide regular payouts. Money market. Arrived is a platform for easily investing in Real Estate, starting from $ Invest in rental properties, earn passive income, and let Arrived take care. Learn how passive income strategies — like REITs, dividend stocks and high-yield savings accounts — can potentially boost your income. This means a steady source of passive income, on top of appreciation. There are tax advantages to being a landlord as well. Creating an LLC for your holdings. Ready to earn some passive income? Here are the basics of creating regular cash flows from investments without breaking (too much of) a sweat. Sources · Deposits · Stocks · Bonds · Rental income and royalties · Digital products. Learn how passive income strategies — like REITs, dividend stocks and high-yield savings accounts — can potentially boost your income. Creating passive income streams takes time, money or both. For instance, you could invest money into income-generating assets like dividend-paying stocks. What I do is building a growth portfolio with individual stocks. Also building a dividend portfolio with 50/50 decent yield to reinvest and.

How to generate passive income from the stock market without having to analyze financial statements and picking stocks. Investing in rental properties is an excellent way to generate a steady passive income. stocks can be another lucrative passive income idea. Owning. The 4 Best Passive Income Investments · 1. Real Estate · 2. Peer-to-Peer Lending · 3. Dividend Stocks · 4. Index Funds. How to make passive income in Canada? Renting properties or possessions, investing in dividend-paying stocks, creating digital products, and investing in. 1. Dividend investing. As a dividend investor, you purchase stocks that share earnings with shareholders by way of dividend payments. · 2. REITs · 3. Bond. Real estate investing. · Invest in art or alternative investments. · Sell designs or art online. · Investing in a high-yield savings account or certificate of. You can invest in index funds, which means you are investing in a collection of stocks to give you a taste of many different sectors of the market – this helps. Passive income ideas · 1. Earn royalties on your photos or artwork · 2. Design printables or templates · 3. Create a website or blog · 4. Rent out a spare room or. Rising dividends is one source of income growth in your portfolio but another powerful driver is using the dividend income you receive to buy more shares. Those. Making passive income through dividend stocks is an effective way to learn how to make money. You will earn income regularly by investing in mutual funds or. Stocks, bonds, real estate, mutual funds, ETFs, alternatives can all generate passive income. Each has its own risk and return profile. Your choice should align. Blogging · Content creation · Selling online · Become an influencer · Create a course · Data Entry · Rental income · Become a rideshare driver. However, the only way to generate useable passive income is by building a taxable investment portfolio, which includes investing in real estate, alternative. There are passive income ideas that don't involve investing – like using your expertise to create and sell content. Make a guide or an instructional video. Passive investing is an investment approach that seeks to maximize returns while minimizing the frequency of trading in the market. Another way to think of. “The most consistently successful path to creating and growing passive income among my clients has been investing in stocks that not only pay a dividend. Unlike growth investments, where you're hoping your wealth grows over time, passive income gives you a more stable cash return. Passive investing also will save. Strategy #5: sell stock photos This might be one of the easiest ways to generate a passive income without any initial funds if you're enjoying being behind. Buy: Passive income investments include dividend stocks, bonds, annuities, and rental properties. You could also buy a small business. Create: You can develop a. To build a sustainable passive income from investing, you should consider investing in a mix of asset classes, e.g. stocks, mutual funds, real estate, foreign.

How To Invest In My 20s

The most important decision you can make is to start investing now. Different types of investment strategies will serve you well as you build your wealth. Educate yourself over time by reading some of the books regularly mentioned on here. Don't react to tips on forums, but use people's comments on their. Financial strategies for your 20s · Build financial literacy · Evaluate income and expenses to create a budget · Start an emergency fund · Manage your debt. Investing in your 20s · You can start off small · Waiting until you're "stable enough" to start investing could mean missing out on years of growth. That's why. In this article, we will discuss why you should invest in your 20s, valuable tips to get started, and various investment options. Here are some strategies for new investors in their 20s and 30s. Save money for the short term, invest for the long term. Buy low cost, well diversified ETFs. Vanguard and Fidelity are both super cheap. I personally use Vanguard and would start with VOO and VBK. My. The Everything Guide to Investing in Your 20s & 30s: Your Step-by-Step Guide to: * Understanding Stocks, Bonds, and Mutual Funds * Maximizing Your. The Everything Investing in Your 20s and 30s Book: Learn How to Manage Your Money and Start Investing for Your Future-Now! [Duarte, Joe] on saitomontazh.ru The most important decision you can make is to start investing now. Different types of investment strategies will serve you well as you build your wealth. Educate yourself over time by reading some of the books regularly mentioned on here. Don't react to tips on forums, but use people's comments on their. Financial strategies for your 20s · Build financial literacy · Evaluate income and expenses to create a budget · Start an emergency fund · Manage your debt. Investing in your 20s · You can start off small · Waiting until you're "stable enough" to start investing could mean missing out on years of growth. That's why. In this article, we will discuss why you should invest in your 20s, valuable tips to get started, and various investment options. Here are some strategies for new investors in their 20s and 30s. Save money for the short term, invest for the long term. Buy low cost, well diversified ETFs. Vanguard and Fidelity are both super cheap. I personally use Vanguard and would start with VOO and VBK. My. The Everything Guide to Investing in Your 20s & 30s: Your Step-by-Step Guide to: * Understanding Stocks, Bonds, and Mutual Funds * Maximizing Your. The Everything Investing in Your 20s and 30s Book: Learn How to Manage Your Money and Start Investing for Your Future-Now! [Duarte, Joe] on saitomontazh.ru

In general, it is a good idea to save 10% to 15% of your income, but even saving less is better than not saving at all. In your 20s, you're starting out in your. These small savings schemes include Post Office deposits, National Savings Certificate, Kisan Vikas Patras, Public Provident Fund, etc. The Government uses. Investing in Your 20s and 30s For Dummies provides novice investors with time-tested advice, along with strategies that reflect today's market conditions. You'. Our experts have put together a range of free resources to support you through your financial journey in your 20s and beyond. To start investing in your 20s, begin by setting aside a portion of your earnings regularly into an age-appropriate diversified portfolio, consider tax-. In this article, we will discuss why you should invest in your 20s, valuable tips to get started, and various investment options. In this blog, we will discuss some key strategies that individuals in their 20s can apply to start making investments. 1. Build your confidence with an emergency account. An emergency fund is the cornerstone of your financial life. Many companies offer a (k) retirement plan to encourage saving, and many partially match what you invest. For example, if you invest 6% of your pay, and your. Investing by age series: Investing in your 20s · Set goals · Max out your retirement accounts · Put aside money for a rainy day · Don't try to beat the market. Select spoke with Barbara Ginty, certified financial planner and host of the Future Rich Podcast, about the importance of saving for retirement in your 20s. 1. Invest in companies. To achieve the long-term aim of steadily growing your wealth, regular investing and planning should be your number one aim. But finding financial freedom starts in your twenties as it's the best time to lay the foundations for your future self. Chances are it's your first time with a. In your 20s, you're in a position to be a bit more aggressive with the way you invest, so I want you to look into low-cost index funds that invest a large. Below are eight investment ideas you should consider while you're young. You certainly don't have to invest in all of them. But by picking just two or three. Using workplace retirement plans and employer matches, health savings accounts, and individual retirement accounts such as a Roth IRA means your savings could. The financial decisions you make in your 20s can have a major impact on your future. Use these tips now to set yourself up for long-term success. The ideal age to begin investing is said to be in your 20s, thus, the best advice anyone can ever give you is to start investing in 20s. Whether you're thinking about buying a home or going travelling, these five habits are here to help you get headed in the right direction.

How Much To Finish A 300 Square Foot Basement

Typically, nowadays basement renovation (or finishing) cost in the Greater Toronto Area or Calgary Metropolitan Region ranges between $45 to $55 per square foot. New construction typically costs between $ and $ per square foot, but additions and customizations may quickly inflate the expense to $ or more per. For an average sized basement, you'll be looking at between $1 and $8 per square foot. Engineered Wood is a premium wood flooring option and will add a layer of. Typically, nowadays basement renovation (or finishing) cost in the Greater Toronto Area or Calgary Metropolitan Region ranges between $45 to $55 per square foot. It will cost you anywhere from $32 to $47 per square foot to finish your sq. ft. basement, which comes out to between $22, and $46, Finishing a basement can cost between $$50 per square foot on average. It Permits for demolition projects cost anywhere from $$ Find an. A square-foot rec room is less expensive than a 1,square-foot basement that also includes a kitchenette and full bathroom. Unfinished Space: If you. Larger basement remodeling projects with high-end finishes and conversion options can cost you about $, Smaller basements (anything under square feet). Basement Finishing. SMALL BASEMENT — – SQ FT — $75, – $, MEDIUM BASEMENT — – 1, SQ. Typically, nowadays basement renovation (or finishing) cost in the Greater Toronto Area or Calgary Metropolitan Region ranges between $45 to $55 per square foot. New construction typically costs between $ and $ per square foot, but additions and customizations may quickly inflate the expense to $ or more per. For an average sized basement, you'll be looking at between $1 and $8 per square foot. Engineered Wood is a premium wood flooring option and will add a layer of. Typically, nowadays basement renovation (or finishing) cost in the Greater Toronto Area or Calgary Metropolitan Region ranges between $45 to $55 per square foot. It will cost you anywhere from $32 to $47 per square foot to finish your sq. ft. basement, which comes out to between $22, and $46, Finishing a basement can cost between $$50 per square foot on average. It Permits for demolition projects cost anywhere from $$ Find an. A square-foot rec room is less expensive than a 1,square-foot basement that also includes a kitchenette and full bathroom. Unfinished Space: If you. Larger basement remodeling projects with high-end finishes and conversion options can cost you about $, Smaller basements (anything under square feet). Basement Finishing. SMALL BASEMENT — – SQ FT — $75, – $, MEDIUM BASEMENT — – 1, SQ.

A square-foot rec room is less expensive than a 1,square-foot basement that also includes a kitchenette and full bathroom. Unfinished Space: If you. However, The average finished basement cost ranges between is $45 to $95 per square foot. cost you $15, to $20,, or about $ to $ per square foot. The Unfinished Basement Cost. The average total cost of an unfinished basement is $6, – $15, · Remodeling a Finished Basement Costs. Finishing a basement should be more like $$60 a square foot. Upvote. About 13 ago I started out my contractor career finishing basements I have finished over 40 Basements. the lowest cost per square foot. How much will a basement remodel cost? · Small ( saitomontazh.ru) – $9, to $52, · Medium ( saitomontazh.ru) – $21, to $, · Large ( saitomontazh.ru) –. Converting existing space (like a guest house, attic, basement, or garage) is typically less expensive than new construction. For such conversion projects. The average cost of finishing a basement is $40,, but the overall cost can range anywhere from a few thousand dollars to $,, depending on the size and. The average cost for Michigan homes is $ per square foot. The final cost will depend on a lot of things, such as the grade of materials used, labor, and if. Basement remodels can be anything from installing new flooring, adding electrical or plumbing, or building models. The average cost for this type of project is. In short, it costs an average of $45 per square foot to finish a basement in Kansas City. Sq Ft Basement, Open Plan, With Rooms. Framing, $, $1, In short, it costs an average of $45 per square foot to finish a basement in Kansas City. Sq Ft Basement, Open Plan, With Rooms. Framing, $, $1, The basic cost to Frame Basement Walls is $ - $ per square foot in April , but can vary significantly with site conditions and options. How much does it cost to finish a basement? · A basement renovation project can cost between $35 and $55 per square foot in Canada. · Basic basement finishing is. On average installing an unfinished basement will generally cost from $10 to $25 per square foot while a finished basement construction cost will be between $ Drywall installation costs $1, to $2, or about $2 per square foot. You'll only need it for new walls, not the existing finished space. Adding electrical. The average cost of basement renovations $$95, and this is per square foot. This would depend on the upgrades and materials you choose. A basement remodel will generally square foot depending on features, finish level, and size. As the size increases, the cost per square foot decreases. A partial remodel of a basement with less than square feet could run anywhere from $10k to $50k, depending on what are you planning with it. While the size and number of walls dictate the exact cost of any project, on average framing cost $6 per square foot including labor and materials. Once framing.

How Much Money Can You Make Trading Forex

As a forex trader, you can make at least 3%-5% of your account monthly on average, however, this figure varies based on several factors. Undoubtedly, the. The more you trade, the more you can earn. Enjoy interest payments and cash rebates for high volume trading. FX VIP - Cash Rewards. Tangible Perks. Save up to. A goal somewhere between 5% to 15% per quarter is reasonable yet still quite attractive, especially for those with larger accounts. Frequently Asked Questions. Many experts suggest that a realistic monthly return for experienced traders might range from 2% to 5%. However, ambitious traders often aim for. There will be points for a Stop Loss. If you need a wider Stop, you can trade lot: this will make each point cost € Stop Loss will be points. As a Forex trader, you can theoretically make millions of dollars. Anything is possible, which is why so many people try to learn how to trade. However, success. Set this % of your total account equal to $, /.5% = $60, But your account fluctuates, sometimes you have multiple wins or loses. As a general rule, most forex traders use a risk/reward ratio of at least Let's say that you use this minimum ratio, you're risking $1 per trade to. If you risk $, then you can make an average of $20, per year. If you risk $, then you can make an average of $60, As a forex trader, you can make at least 3%-5% of your account monthly on average, however, this figure varies based on several factors. Undoubtedly, the. The more you trade, the more you can earn. Enjoy interest payments and cash rebates for high volume trading. FX VIP - Cash Rewards. Tangible Perks. Save up to. A goal somewhere between 5% to 15% per quarter is reasonable yet still quite attractive, especially for those with larger accounts. Frequently Asked Questions. Many experts suggest that a realistic monthly return for experienced traders might range from 2% to 5%. However, ambitious traders often aim for. There will be points for a Stop Loss. If you need a wider Stop, you can trade lot: this will make each point cost € Stop Loss will be points. As a Forex trader, you can theoretically make millions of dollars. Anything is possible, which is why so many people try to learn how to trade. However, success. Set this % of your total account equal to $, /.5% = $60, But your account fluctuates, sometimes you have multiple wins or loses. As a general rule, most forex traders use a risk/reward ratio of at least Let's say that you use this minimum ratio, you're risking $1 per trade to. If you risk $, then you can make an average of $20, per year. If you risk $, then you can make an average of $60,

YES! It's definitely possible to make a consistent income from Forex trading. We're at the start of Part III of the guide where we'll. Investors can trade almost any currency in the world through forex. To make money, you are betting that the value of one currency will increase relative to. Can you make money trading forex? Yes. And at the same time, that's a hugely qualified “yes,” as it hinges on abandoning the myth that forex trading guarantees. To increase the money available to them, traders often use leverage, which is essentially trading with borrowed money. Compared to other securities types. A Forex trader and make $ a day, while another, using the same strategies makes $ a month. Therefore is not only about what strategies you use. In reality, experienced traders who employ robust risk and money management rules can make about $50 to $ a day depending on their forex trading strategy. However, becoming rich depends on your skill and strategy and, as always, some luck. If you are a new trader looking for some inspiration, you might want to. Theoretically speaking, the answer is “As much as you can handle”. Sounds good? Well not quite. You see, in practice this question has little significance. If you think this amount of money isn't worth bothering, there's great news: your broker can help you make much more money with a special tool called leverage. Traders make a prediction on forex pairs to profit from one currency strengthening or weakening against another. When the price of a pair is rising, it means. So, traders can expect to earn money - according to the search results, traders are offered more than $, per month, with more than 40 jobs for the US. It's legitimately possible to make money trading forex. This guide will help you calculate how much you could actually earn. By. Tim Fries. According to saitomontazh.ru, junior traders typically earn between USD$,$3 million a year, while senior portfolio managers can earn over $10 million per. Number of Trades: Let's say you make four trades in a day. · Winning Trades: In two of the trades, you make a profit of $ each, with a However, in practice professional traders return % a month, so a return of % is both a realistic and a reasonable expectation. Remember that currency. Every time you make a trade, you will incur a cost. If you are trading with an Axi pro trading account, you will incur a $USD per side cost or $USD Earnings can range from a few thousand to tens of thousands of dollars monthly. Institutional Trader: Institutional traders working for banks. In , the average daily turnover in global forex markets was estimated at about 5 trillion USD. It is not unusual for traders to dream of obtaining. Forex earnings don't remain steady based on specific circumstances; rather, their total amount varies based on different aspects. But don't be. Even with $10, $, $1,, or a $15, funded account, you can begin to trade Forex and develop a forex income. Work your way up to those figures and can.